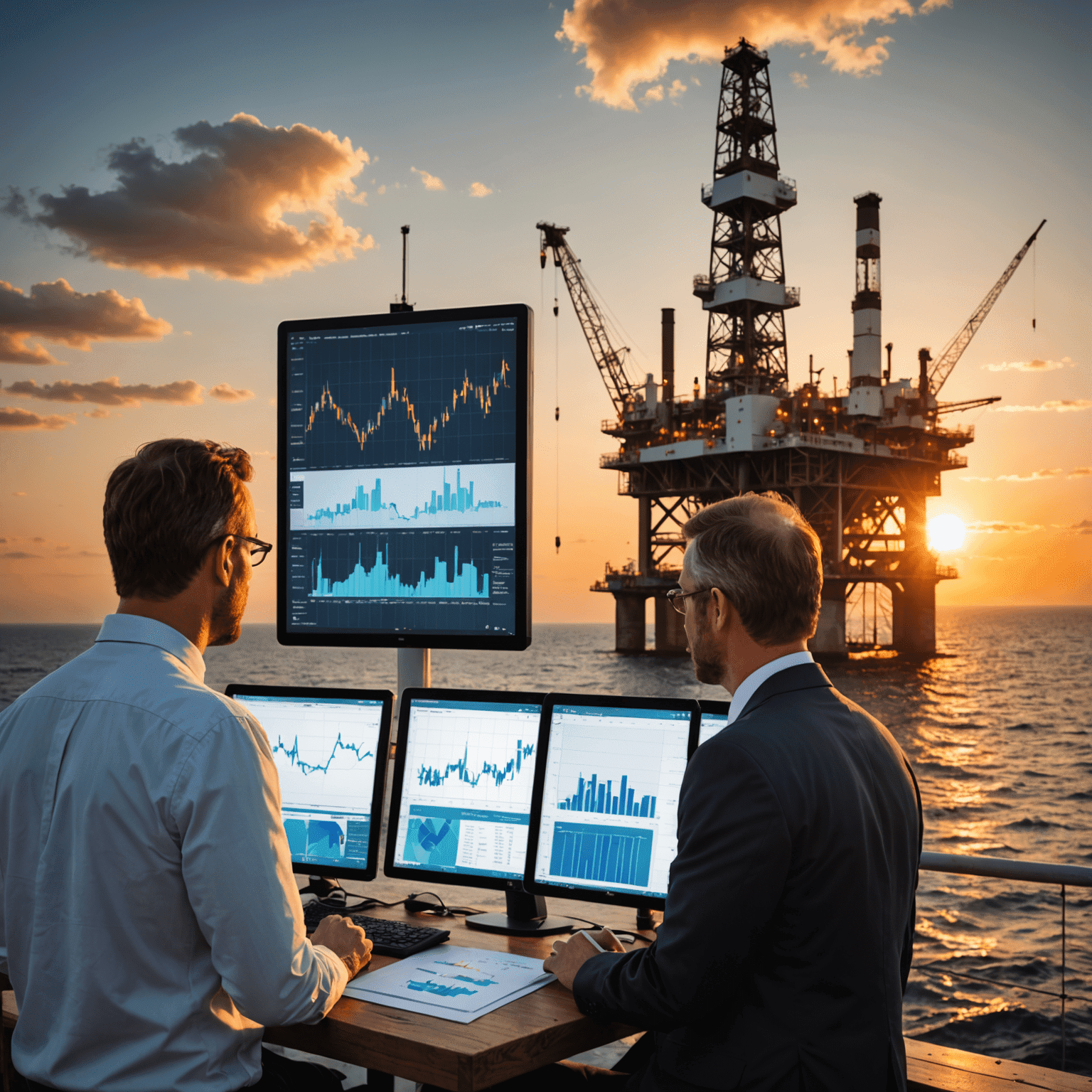

Maximizing Passive Income from Oil Investments

In the world of investments, oil continues to be a lucrative option for those seeking to build a sustainable passive income stream. This guide will walk you through strategies and tips to optimize your returns in the oil sector.

Understanding the Oil Market

Before diving into investments, it's crucial to grasp the fundamentals of the oil market. Oil prices are influenced by global supply and demand, geopolitical events, and technological advancements. Stay informed about these factors to make educated investment decisions.

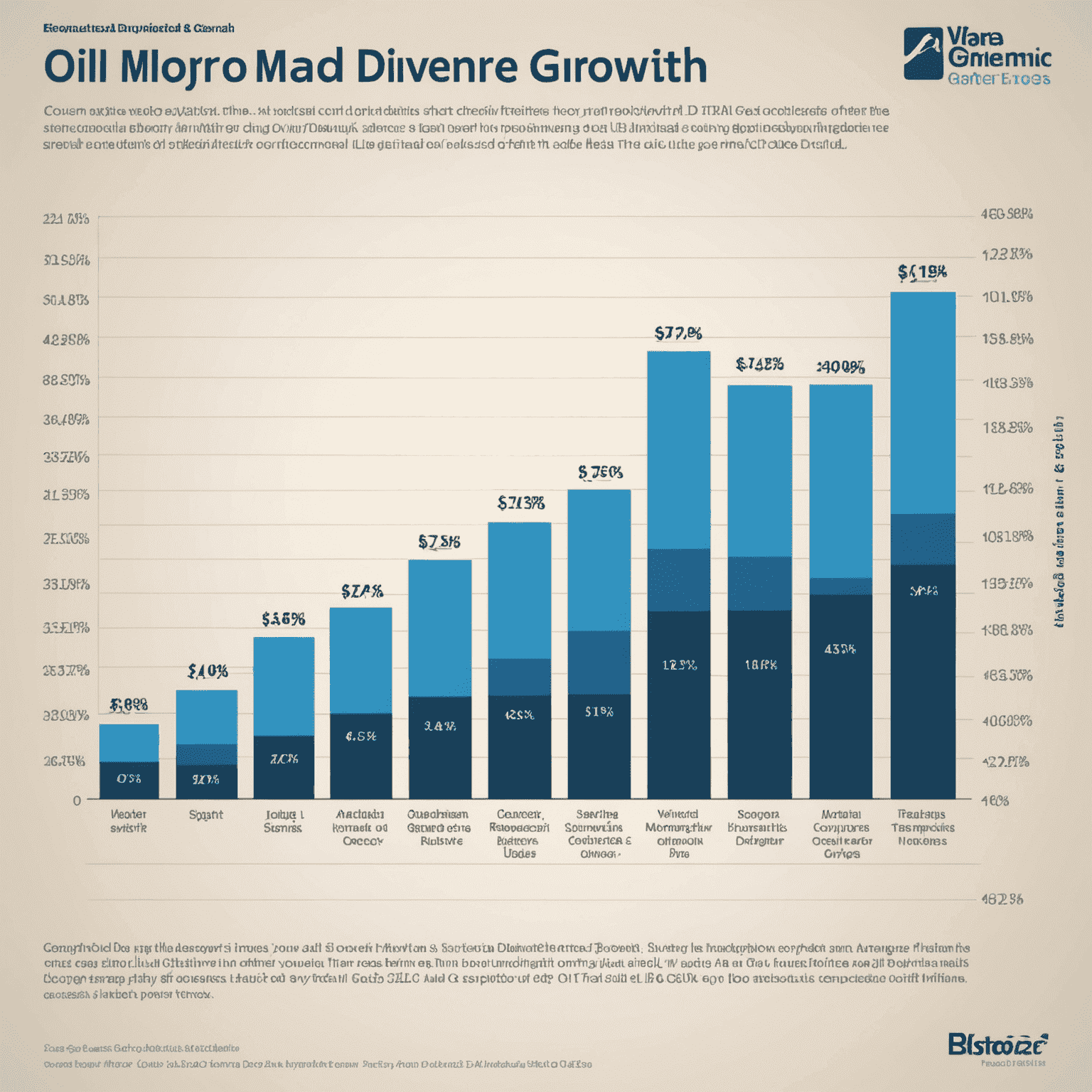

Diversification is Key

To maximize your passive income potential, consider diversifying your oil investments across different areas:

- Oil ETFs (Exchange-Traded Funds)

- Oil company stocks

- Master Limited Partnerships (MLPs)

- Royalty trusts

Focus on Dividend-Paying Stocks

Many established oil companies offer attractive dividends. Look for companies with a history of consistent dividend payments and growth. These can provide a steady stream of passive income, even when oil prices fluctuate.

Explore Midstream Companies

Midstream companies, which focus on transportation and storage of oil, often offer more stable returns compared to exploration and production companies. They're less affected by oil price volatility, making them an excellent choice for passive income seekers.

Consider Royalty Trusts

Royalty trusts can provide high-yield income streams from oil and gas properties. They distribute a large portion of their income to shareholders, making them attractive for passive income generation.

Stay Informed and Adapt

The oil industry is dynamic, with new technologies and global events constantly shaping its landscape. Stay informed about industry trends, environmental regulations, and alternative energy developments to adjust your investment strategy accordingly.

Reinvest for Growth

To build a substantial passive income stream, consider reinvesting a portion of your dividends and returns. This compound growth strategy can significantly boost your long-term income potential.

Manage Risks

While oil investments can be lucrative, they come with risks. Implement risk management strategies such as:

- Setting stop-loss orders

- Regularly rebalancing your portfolio

- Hedging against oil price volatility

Conclusion

Maximizing passive income from oil investments requires a combination of market knowledge, strategic diversification, and ongoing management. By following these strategies and staying informed about industry developments, you can build a robust passive income stream that taps into the potential of the oil sector.

Remember, all investments carry risks. It's advisable to consult with a financial advisor before making significant investment decisions.